Deposit account origination you can bank on

Dial up growth, and dial in the experience. Earn primacy by making banking easier, faster, and better.

Join the financial services firms redefining origination

Blend enables financial services firms to power an average of more than $5 billion in financial transactions every day.

Where good infrastructure become out-of-the-box solutions

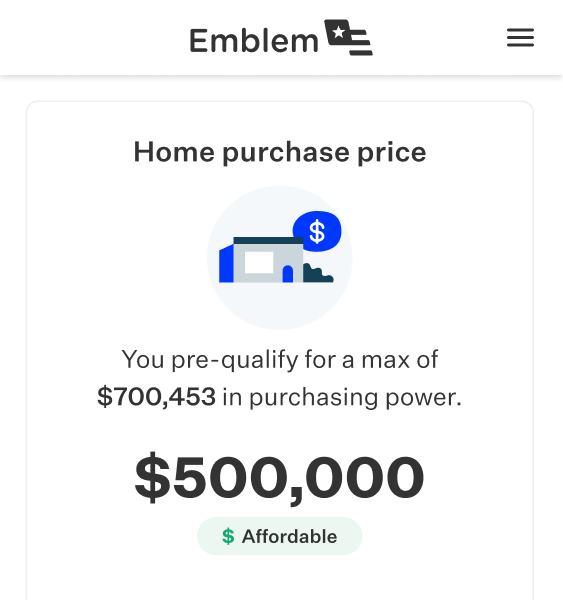

Mortgage Suite

Transform the home-buying process, end-to-end digital solution

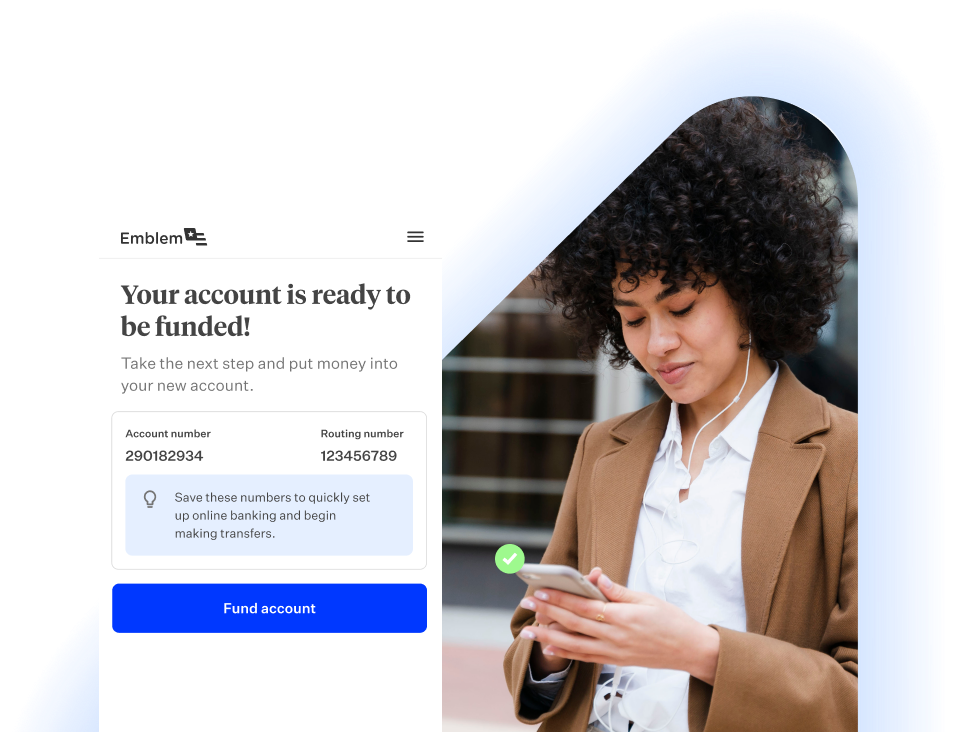

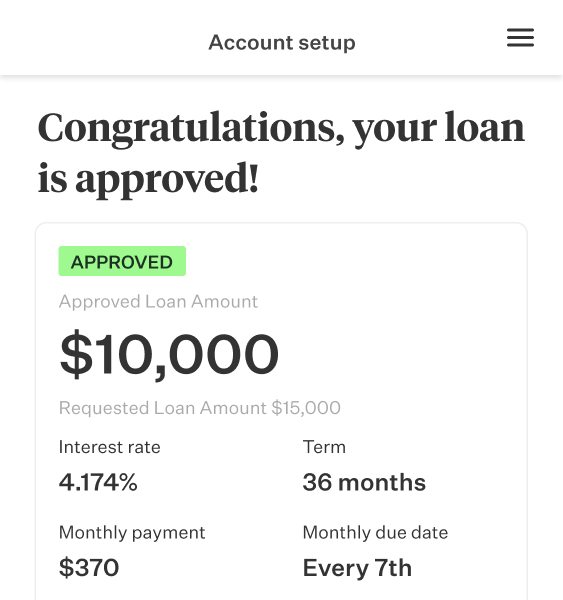

Consumer Banking Suite

Upgrade the way you do business, grow conversions across your portfolio

Accelerate innovation with a platform built to evolve with you

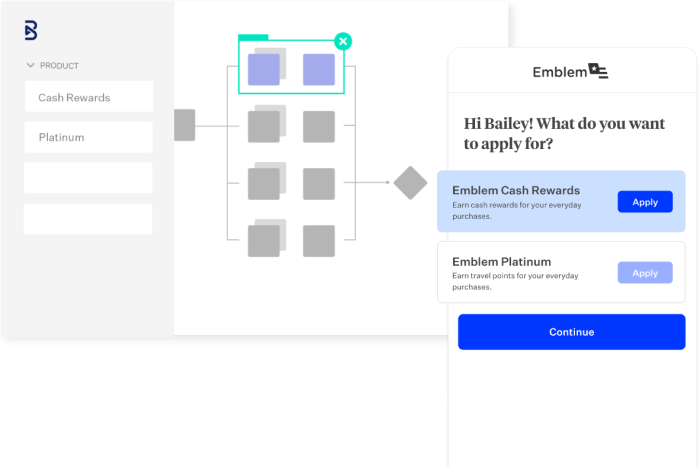

Create and deploy unique customer journeys with ease

Our low-code, drag-and-drop design tools allow development of new products in record time.

Tap into the power of our extensive ecosystem

Leverage a vast community of technology, data, and service providers to deliver seamless customer journeys.